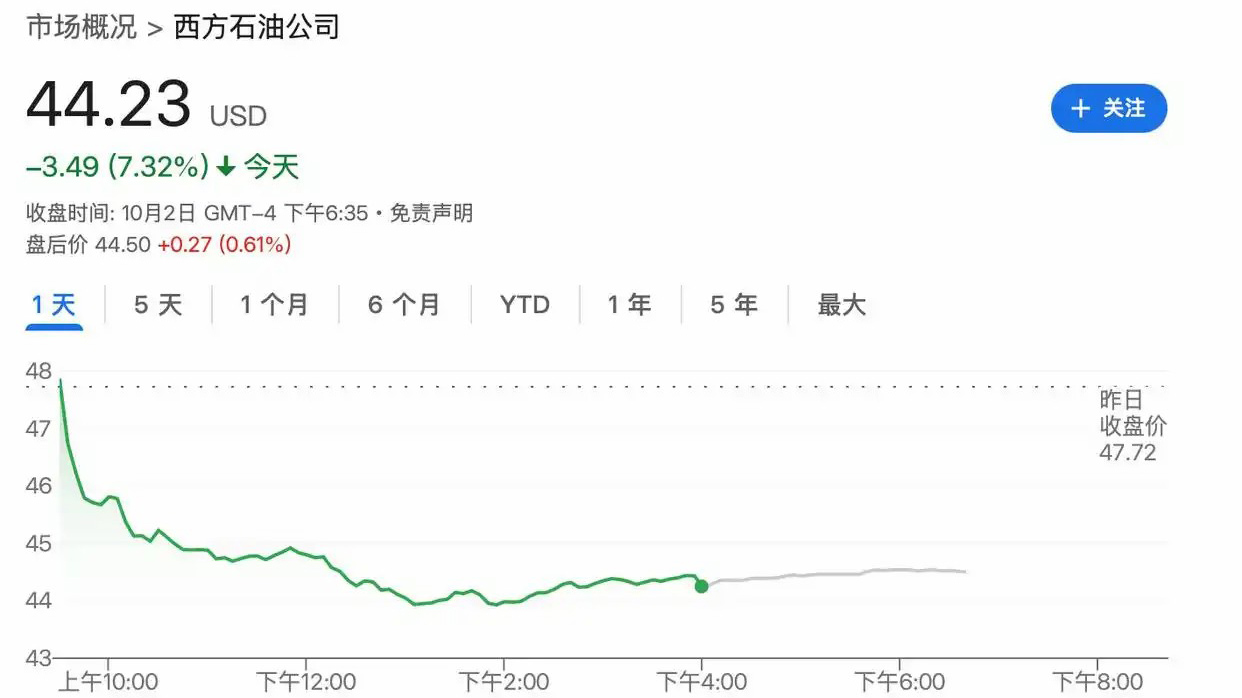

Occidental Petroleum’s stock dropped as much as 7.5% on Thursday, making it one of the biggest losers in the S&P 500. Reports say the company has agreed to sell its chemical business, OxyChem, to Warren Buffett’s Berkshire Hathaway for $9.7 billion. This move is meant to help reduce the heavy debt the company took on from its costly acquisitions over the years.

Electric Remote Control Aluminum Windows & All Season And Four Season Sunroom

Vicki Hollub, CEO of Occidental Petroleum, said in an interview that their biggest challenge right now is finding a faster way to cut down debt. The company bought Anadarko Petroleum in 2019 and CrownRock in 2024. Hollub mentioned they plan to use the $6.5 billion they earned from these deals to pay off some of their debt, aiming to bring it below $15 billion.

Hollub pointed out that this deal should help boost the stock’s worth, making existing shareholders feel more confident about holding onto their shares and drawing in new investors. She said, “Now we can restart our stock buyback program... this is the last piece we needed after kicking off our big transformation ten years ago.”

Analysts at TD Cowen think the timing of this deal isn’t great. While selling the unit will help cut down the company's debt, it comes at a tricky time when OxyChem is just starting its big, multi-year expansion with lots of money planned for it. Because of this, they believe the company might miss out on a key point where free cash flow was expected to start improving in the next few years. Roth MKM also mentioned that selling the unit could hurt future free cash flow growth since it was seen as a core part of the company's expansion plans. Paul Cheng from Scotiabank pointed out that the price for the sale seems pretty low, especially since he had estimated the unit’s value at around $12 billion before.

Electric Remote Control Aluminum Windows & All Season And Four Season Sunroom

Occidental Petroleum, based in Houston, is mainly known for its oil and gas business. Its market value is around $46 billion right now. Berkshire Hathaway is the biggest owner, with over $11 billion worth of shares, which makes up about 28.2% of the company. Warren Buffett has said he doesn’t plan to take full control of Occidental, which was started by the famous oil pioneer Armand Hammer.

Occidental Petroleum’s petrochemical side, called OxyChem, makes and sells all kinds of chemicals used in stuff like disinfecting water, recycling batteries, and making paper. Over the past year ending June 30, they raked in close to $5 billion in sales.

Electric Remote Control Aluminum Windows & All Season And Four Season Sunroom